My business partner grew up in a family that was in the demolition business. Her father owned a company that destroyed buildings, and many of her brothers also went into the family line of work.

As a kid, she and her brothers would routinely go to demolition sites to salvage materials and clean up. When you grow up with this kind of experience, looking at the end cycle of a building, you have a unique understanding of the longevity and strength of certain construction.

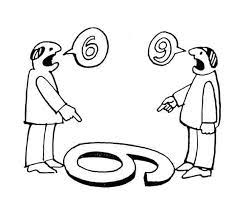

As investors, we often forget that our perspective is constantly seasoning how we view our real estate investments. Today we’re talking about how to look at other perspectives to become a stronger investor.

The Power of Experience in Multifamily Investing

Multifamily real estate investment offers a unique avenue for wealth creation and financial stability. Beyond the theoretical knowledge gained from books and seminars, there lies a wealth of invaluable lessons that only experience can impart.

Case Study: Water in the basement

Recently, we had an apartment building with water in the basement. There was a sump pump that ran regularly, but the water continued to come in as a constant trickle even though it was not raining or wet outside.

Even the owner was puzzled by this, but a tour with a prospective investor turned up a new perspective. “Oh, in my main market area, there is a high underground river and most of the properties have some water in the basement because of the high water table. As long as it’s minimal, and dealt with properly, these buildings have stood for 100 years.” Well, okay then.

Having that understanding and knowledge from past experience allowed this investor to turn his attention to more important parts of the deal, and he will likely secure a great deal that others have passed over because of his perspective.

Understanding Unique Market Dynamics

Just like the investor who knew that water tables are higher in some areas than others, knowing what to expect at the local level is the best way to truly know the market. If you aren’t as familiar, make sure you ask someone who is. Be humble enough to ask from advice.

As a broker, I hear a lot of information passed down from investors, and I always appreciate when someone asks for our local market knowledge with the intent to really listen and learn!

Property managers, other investors, municipalities, and social media can all be great resources for gathering local market intel.

Mitigating Risks and Maximizing Returns

Sometimes the best question to ask is “What am I missing?”

And those around you will tell. Tenants can also be a great source of REAL information on a building’s good and bad points.

Experience is really teaching investors how to optimize their investment strategies to maximize returns while minimizing risk exposure. Whether through value-add renovations, strategic financing, or portfolio diversification – seasoned investors leverage their personal experience to identify opportunities for growth and capital appreciation.

Conclusion: The Evolution of an Investor

As you grow as an investor, make sure you’re capitalizing on your unique experience, just like my colleague who grew up in the demo business. Knowing whether that cracked foundation is the end of property or just an easy fix can allow you a perspective that provides an opportunity for greater returns.

Look for the items you can relate to: for instance, if you grew up in a trailer park, buy mobile home parks! I grew up on a farm, so I can relate well to land and development.

To make your experience count, keep a curious mind and “stay thirsty my friends” – for knowledge!